|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

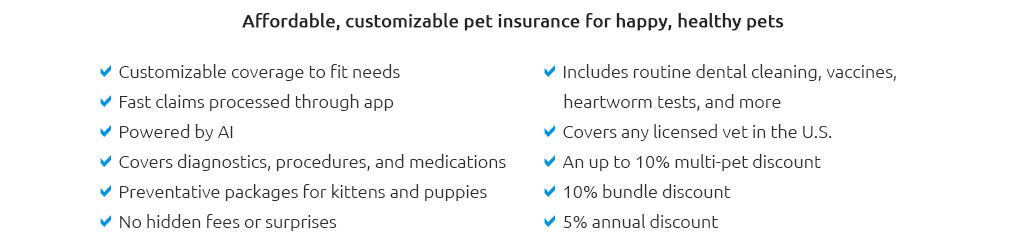

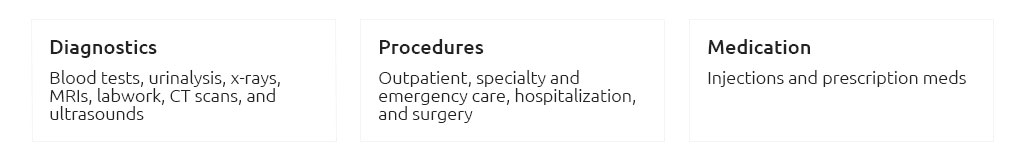

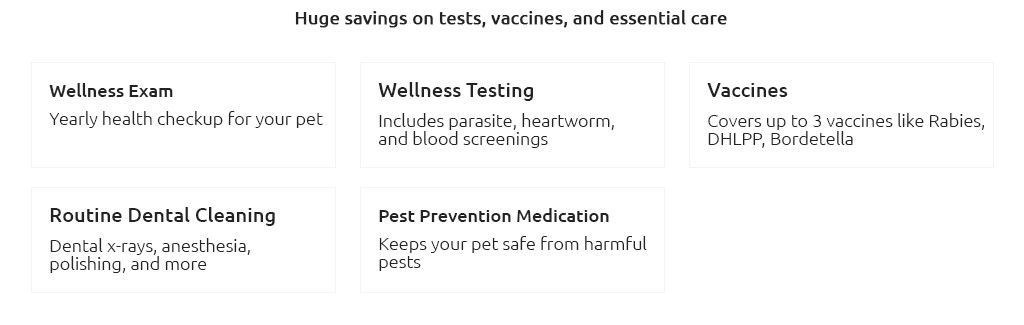

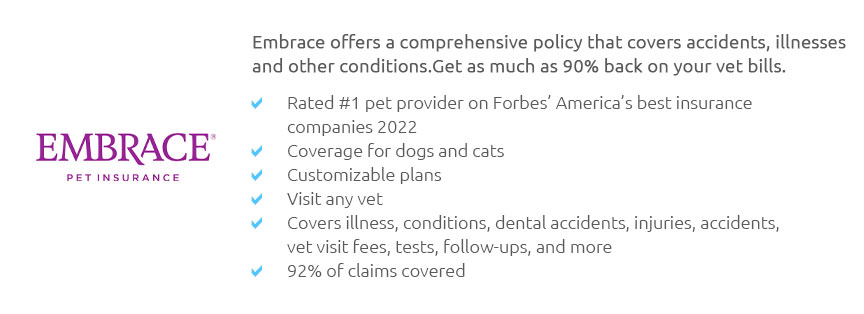

Understanding Pet Insurance in Virginia: A Comprehensive GuideIn the picturesque state of Virginia, where the landscape ranges from the majestic Blue Ridge Mountains to the serene shores of the Atlantic, pet owners are increasingly considering the benefits of pet insurance. This burgeoning interest is driven by the desire to provide the best possible care for their furry companions, amidst rising veterinary costs. Pet insurance, a relatively new concept for many, offers a financial safety net that can make a significant difference in how pet emergencies are managed. In this article, we will delve into the intricacies of pet insurance in Virginia, examining its advantages, potential drawbacks, and considerations specific to the region. Why Pet Insurance? The primary allure of pet insurance is the peace of mind it offers. Veterinary care can be unexpectedly expensive, and without insurance, pet owners may face tough decisions when it comes to treatment options. Insurance can cover a range of services, from routine check-ups to emergency surgeries, thus ensuring that pets receive the care they need without causing financial strain. For many Virginians, this means that their beloved pets can enjoy long, healthy lives without their owners having to worry about prohibitive costs. Types of Coverage Available

Considerations for Virginia Residents Virginia's diverse climate and geography pose unique challenges and opportunities for pet owners. From tick-borne diseases in rural areas to urban hazards in cities like Richmond and Arlington, the needs of pets can vary significantly. Therefore, choosing a pet insurance plan that accounts for these regional factors is crucial. Moreover, some insurers might offer discounts or special packages tailored to Virginia residents, considering the state's specific needs and common claims. The Decision-Making Process Deciding on pet insurance involves weighing the potential costs against the benefits. Prospective policyholders should evaluate their financial situation, the age and health of their pet, and the likelihood of needing extensive veterinary care. Many insurance providers offer online tools to compare plans and premiums, which can be incredibly helpful in making an informed decision. Additionally, consulting with local veterinarians can provide insights into common health issues in Virginia, further guiding the choice of insurance coverage. In conclusion, while pet insurance is not a one-size-fits-all solution, it offers undeniable advantages for pet owners in Virginia. By alleviating the financial burden of unexpected veterinary expenses, it allows owners to focus on what truly matters-providing a loving and healthy environment for their pets. As more Virginians embrace pet insurance, it stands as a testament to the growing recognition of pets as integral members of the family, deserving of the best care possible. Whether through accident-only plans or comprehensive coverage, the right insurance policy can be a valuable ally in ensuring that pets live long, happy, and healthy lives. https://www.petinsurance.com/whats-covered/virginia/

The best pet insurance ever by Nationwide. Plans that cover wellness, illness, emergency & more. Use any vet. Up to 90% back on vet bills. 877-263-6008. https://www.metlifepetinsurance.com/state/virginia/

Explore MetLife's flexible, affordable pet insurance coverage in Virginia! Get a quote today, and help your pets stay healthy while you save on vet bills. https://www.lemonade.com/pet/explained/virginia-pet-insurance-guide/

eligible accidents and illnesses. Here are some common types of care that Lemonade pet insurance ...

|